There are quite a few jokes floating around asset management circles about the lack of sophistication exhibited by the average Chinese investor compared to more experienced investors from the West. But… well, the joke is on them because this lack of sophistication is temporary at best and in some cases, such claims actually turn out

Our Blog

Jun

- No Comments

How Likely Are Chinese Investors to Pay for Asset Management Services?

According to McKinsey, the Asian wealth market will most likely at the very least double by the year 2025, overtaking the United States with its $30 trillion+ value. With entrepreneurship becoming more widely-spread and an ever-increasing class of high net worth individuals emerging, it should come as no surprise that China is poised to grab

Jun

- No Comments

The 2019 State of Investment Funds in China

From $5.3 trillion in assets under management at this point to an expected level of $9.3 trillion and beyond by 2023 (according to the Oliver Wyman consulting firm), the sector is poised to continue booming in China, especially in light of the increased flexibility the authorities are displaying due to the demographic realities of china

Jun

Should Chinese Bonds Be Considered Attractive?

In light of the fact that the yuan-denominated bond market is becoming an option for foreigners (with, for example, the Bloomberg Barclays Global Aggregate Index including yuan-denominated bonds as of April 2019), it makes sense to ask yourself if you should or shouldn’t try to grab a piece of such a huge pie, with roughly

Jun

- No Comments

Bullish on China = Bullish on Precious Metals?

As of the liberalization of the market back in the late nineties, Chinese investors have developed quite an appetite for gold and precious metals. According to the World Gold Council, their appetite has been so unquenchable that as of 2013, China became the world’s #1 market for gold. In fact, just like with many other

Jun

- No Comments

The Pros and Cons of Investing in Chinese Stocks

Are you a proud Amazon shareholder? Why not add some Alibaba Group Holding shares to the mix? Or perhaps you’re a huge Facebook fan and love buying their stocks… why not diversify a little bit and add some Tencent Holdings shares to your portfolio. Into Google rather than the previous two examples? Great… but why

Jun

- No Comments

Is China Overrated or Underrated?

The short answer is… well, yes! To elaborate, it’s important to understand that people always love picking sides, picking a proverbial team that they stand behind. And investors are… you’ve guessed it, people. As such, they tend to see things as either black or white, with little to no room for grey areas. China has

Jun

- No Comments

Macroeconomic Outlook, Opportunities and Challenges for China

Macroeconomics is yet another instance where phrases which revolve around the fact that the only constant is change are relevant. Times change, variables change, people change and macroeconomic trends cannot help but keep up. As such, it makes sense to keep the most important macroeconomic realities of the present in mind and be on the

Jun

- No Comments

Are Reforms (Still) Necessary in China?

As an outside observer, it’s hard not to succumb to the temptation of continuously praising China for its post-1978 economic results. Indeed, the reforms implemented by its post-1978 leaders, from Deng Xiaoping to Xi Jinping, have generated impressive economic growth in a way that past generations would have had difficulties even trying to comprehend. However,

Jun

- No Comments

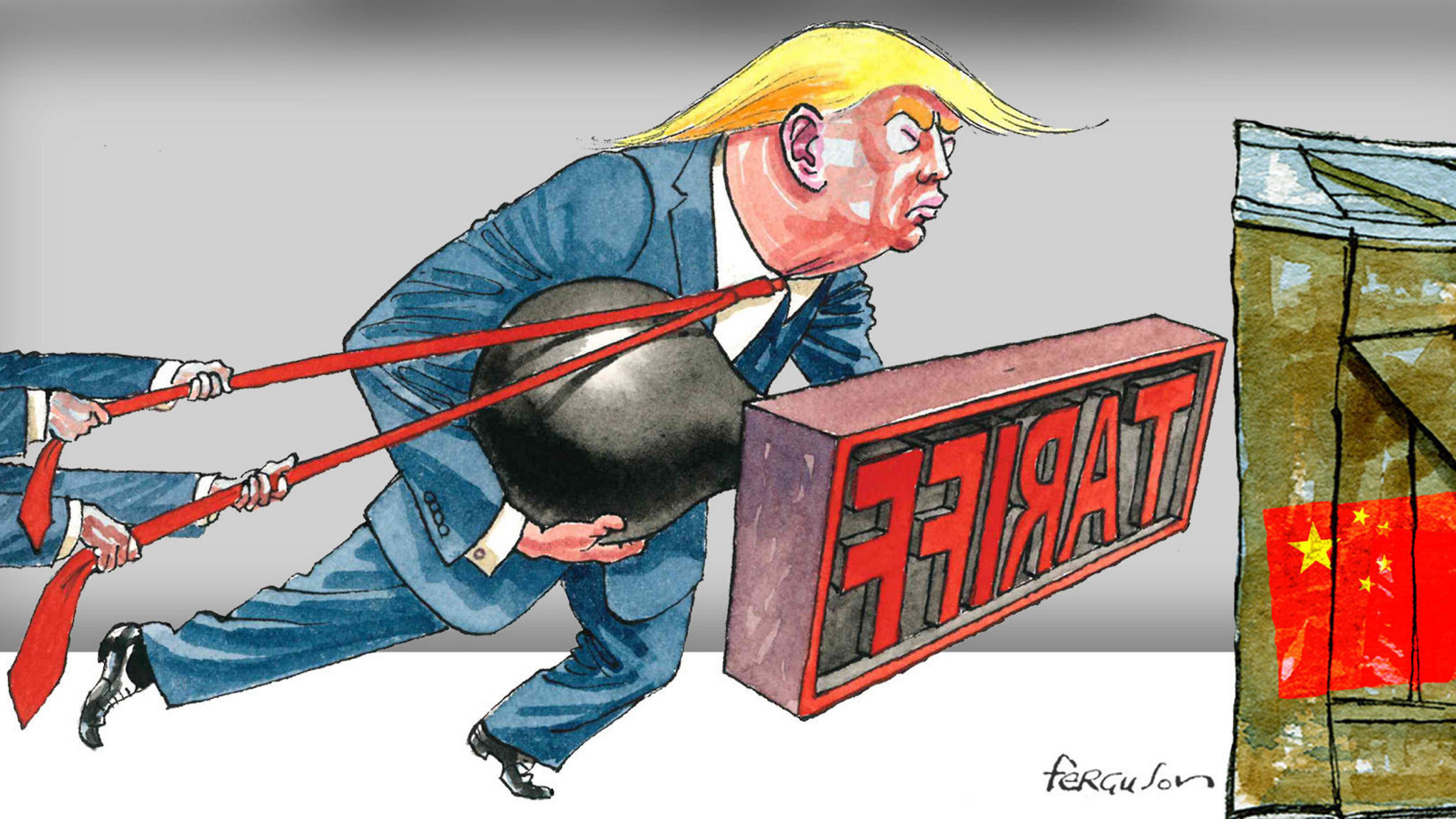

China and Globalization: From Generational Opportunity to Systemic Risk

In the Western world, globalization has many enemies and the reasons are not hard to understand. In light of the fact that many Western companies decided to either outsource or move to countries with lower workforce costs altogether, many domestic employees who thought the could count on job security were left vulnerable. To give you