Right off the bat, it is important to point out that this article refers to simply selling assets that you currently hold as opposed to short selling. When it comes to short selling in general and short selling Chinese assets in particular, there is a separate article dedicated to just that on our website, one

Investing in China

Feb

- No Comments

Corruption in China: Temporary Roadblock or Long-Term Curse?

Not only is this article written from the perspective of ChinaFund.com’s managing partner (the managing partner of an entity with a hands-on experience in China which exceeds 13 years), it’s also written from the perspective of someone who grew up in Eastern Europe, in a country that became essentially (in)famous at the very least regionally

Feb

- No Comments

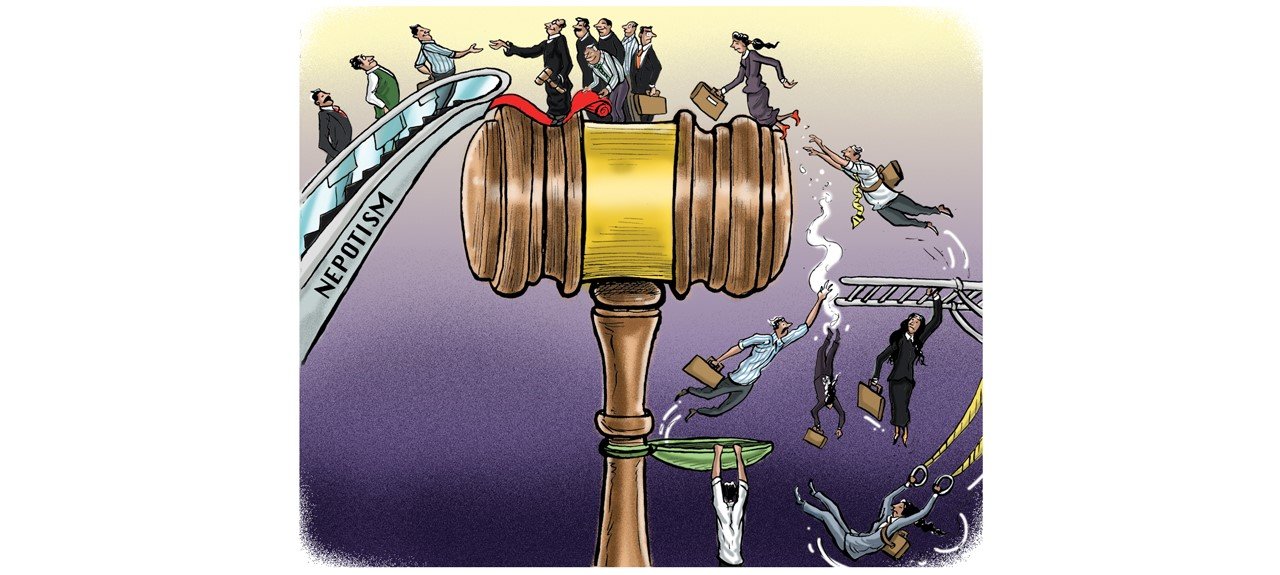

Nepotism in China: Nuisance or Disruptive Factor?

Western investors have varying reactions to… let’s call them certain Chinese realities. Issues pertaining to nepotism most definitely do not represent exceptions. It ultimately does depend to a significant extent on their country of origin. To give a few examples pertaining to Europe: someone from Northern Europe may find any kind of nepotism unacceptable, a

Feb

- No Comments

Arbitration in (Mainland) China: Effective Solution or Bureaucratic Nightmare?

When analyzing a jurisdiction from a business perspective, it makes sense to dedicate enough time to the arbitration dimension as well rather than simply refer to court-related solutions. As pretty much anyone who has been at least somewhat involved with any court system can confirm, this solution is oftentimes not only a bureaucratic nightmare but

Jan

- No Comments

(Financial) Predictions About China: Misleading Marketing Gimmicks vs. Meaningful Metrics

One of the main drawbacks associated with being an economist is represented by the fact that most individuals believe they know exactly what you do for a living (perhaps even that they could do it better, but that is an entirely different discussion) and when you ask them what that is, they present an extremely

Jan

- No Comments

Is China’s Economy a Ponzi Scheme?

Quite a few analysts have voiced concerns that China’s economy is essentially a Ponzi scheme which needs perpetual growth to sustain itself. From the (in)famous South China Morning Post op-ed of Jake Van Der Camp to a wide range of criticism by Kyle Bass and other financial media opinion formers, it has become clear that

Jan

Doing Business in China: Hands-on Tips from ChinaFund.com

As those of you who are familiar with our work and track record know, the experience of the ChinaFund.com team let’s say transcends the financial world. To put it different, we have proverbially been there and done that in China for over 13 years when it comes to anything from brick & mortar endeavors to,

Jan

- No Comments

Wealth Management in China: New Frontier or Pipe Dream?

As explained on more than one occasion here on ChinaFund.com, tremendous wealth has been built in China since let’s say the Deng Xiaoping reform days. However, we would be painting an incomplete picture of reality by limiting ourselves to the previous statement. In the spirit of precision, we need to make it clear that two

Jan

- No Comments

Financial Panic(s) in China: Systemic Risk or Tradeable Opportunity?

Whether we are referring to “maturing” jurisdictions such as China or mature ones such as various Western jurisdictions, it is a quasi-axiomatic statement that one cannot have a man-made financial system without occasional financial panics. From bank depositors who are standing in line in a desperate attempt to withdraw while they still can to investors

Jan

- No Comments

Volatility in China: Deal Breaker, Necessary Evil or Opportunity?

Whether we are referring to anything from asset prices to the legislative dimension, volatility is most definitely something one cannot ignore in China, more so than in more mature Western jurisdictions. Some investors choose to stay away from China altogether for this very reason (in other words, volatility represents a deal breaker) As far as