As peculiar as it may seem, many analysts believe that one of the “perks” associated with authoritarian governance is represented by the fact that one can “have everything under control” when it comes to the main follies of capitalism: excessive greed, excessive fear, manic-depressive behavior which leads to anything from irrational exuberance on the way

Financial Sector

Dec

Dec

- No Comments

The People’s Bank of China (PBOC) vs. Western Counterparts

The People’s Bank of China (abbreviated PBC, or more commonly PBOC) has been the world’s “richest” central bank by asset valuation since July of 2017, a valuation north of $3 trillion at the moment of writing. Just like any other central bank, the PBOC has responsibilities with respect to setting monetary policy and acting as

Oct

- No Comments

(Financial) Fraud in China: How to Avoid Portfolio-Disrupting Scams

When it comes to financial crimes committed within China, the laws at least (even if the efficiency of the authorities with respect to applying them can sometimes be questionable) are very strict and as such, a valid case can be made that a strong legislative disincentive exists. But as far as laws that pertain to

Sep

- No Comments

Is China on the Verge of Becoming a Cashless Society?

Finding out that China was the first nation to introduce banknotes comes a surprise to many and it tends to come as even more of a surprise for the average Western observer to hear that yes, China is genuinely on the verge of becoming a cashless society, with over two-thirds of its citizens having switched

Jul

- No Comments

China’s 2015-2016 Stock Market Crash and Its Consequences

On the 5th of June 2015, a severe market crash started from which China has not been able to fully recover. On the contrary, despite a recovery starting as of February of 2016, prices were not able to get anywhere near their pre-crash highs and, in fact, they went to new lows toward the end

Jul

- No Comments

China’s Banking System: Past, Present and Future

We’ve covered various concerns pertaining to China’s shadow banking system in a previous article, so it makes sense to also pay attention to… well, its “actual” banking system. And, right off the bat, let’s just say the “Past” dimension of this article will be very brief, for the simple fact that there isn’t really all

Jul

- No Comments

Shadow Banking in China: Is Enough Being Done?

In 2019, we can confirm the first full-year decline in terms of Chinese shadow banking volume in over 10 years (2018 compared to 2017), after the authorities started paying serious attention to this dimension of the financial sector as of 2017. Still, we’re looking at a whopping $9.1 trillion in outstanding shadow banking loans, which

Jun

- No Comments

How Likely Are Chinese Investors to Pay for Asset Management Services?

According to McKinsey, the Asian wealth market will most likely at the very least double by the year 2025, overtaking the United States with its $30 trillion+ value. With entrepreneurship becoming more widely-spread and an ever-increasing class of high net worth individuals emerging, it should come as no surprise that China is poised to grab

Jun

- No Comments

The 2019 State of Investment Funds in China

From $5.3 trillion in assets under management at this point to an expected level of $9.3 trillion and beyond by 2023 (according to the Oliver Wyman consulting firm), the sector is poised to continue booming in China, especially in light of the increased flexibility the authorities are displaying due to the demographic realities of china

Jun

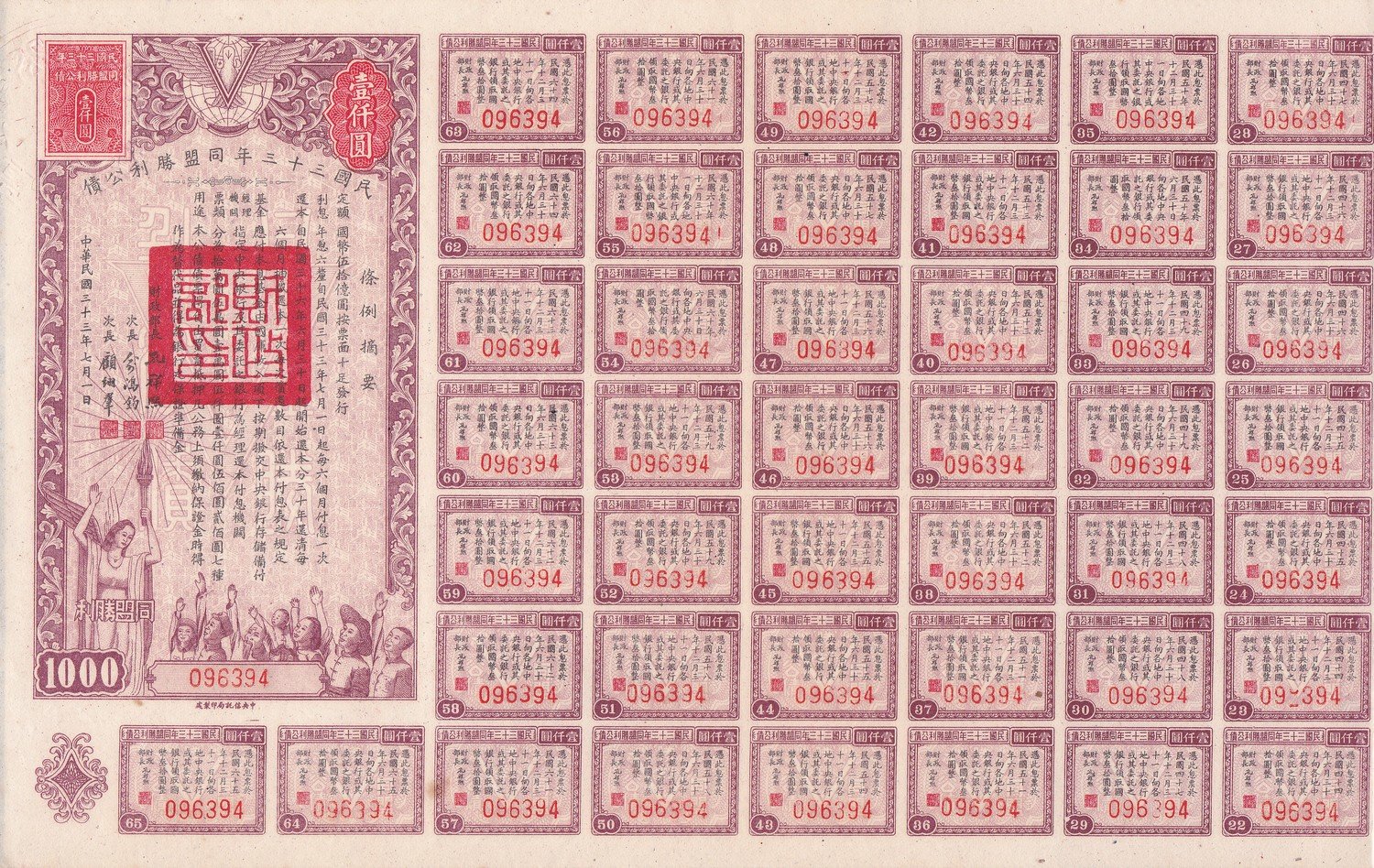

Should Chinese Bonds Be Considered Attractive?

In light of the fact that the yuan-denominated bond market is becoming an option for foreigners (with, for example, the Bloomberg Barclays Global Aggregate Index including yuan-denominated bonds as of April 2019), it makes sense to ask yourself if you should or shouldn’t try to grab a piece of such a huge pie, with roughly