We will be brutally blunt right from the beginning: those who assume the COVID-19 crisis will not change the worldwide political landscape dramatically are deluding themselves. From causing problems directly to making already-existing ones crystal clear, a calamity such as the one which affected humanity in 2020 cannot simply go by consequence-free politically speaking. Let

Our Blog

Jul

- No Comments

Are Chinese and Western Savers Being Bailed Out or Sacrificed?

Here at ChinaFund.com and on pretty much any let’s call it financial outlet, quite a bit of energy has been continuously dedicated to market participants (from the average consumer to large corporations) who have been caught off-guard by 2020’s developments or, the same way, by the Great Recession or any other past calamity. We’ve written

Jul

- No Comments

Are Chinese and Western Small Businesses Caught in the Post-2020 Crossfire?

The bailout of Boeing and other large companies by the United States has made a mega-trend crystal clear: small business owners are growing increasingly frustrated with the attention “systemically relevant” corporations are receiving and the fact that, just like in the aftermath of the Great Recession, large entities are positioning themselves as spoiled children of

Jul

- No Comments

The “End” of Globalization? A Chinese Perspective

Pretty much any intellectually honest observer who has been keeping a close eye on geopolitical developments since at least 2016 can confirm that globalization hasn’t exactly been on a popularity increase spree. From let’s call them victories of isolationism such as the 2016 Brexit vote and the 2016 US elections to shocks such as the

Jul

- No Comments

China in the Context of Increasingly Adversarial International Relations

A worldwide calamity brings out the best and worst in both people and… well, nations as geopolitical actors. Unfortunately, the COVID-19 pandemic has done quite a bit when it comes to the latter in both cases, with nations acting in such an adversarial manner in many instances that the very foundation of international trade risks

Jul

- No Comments

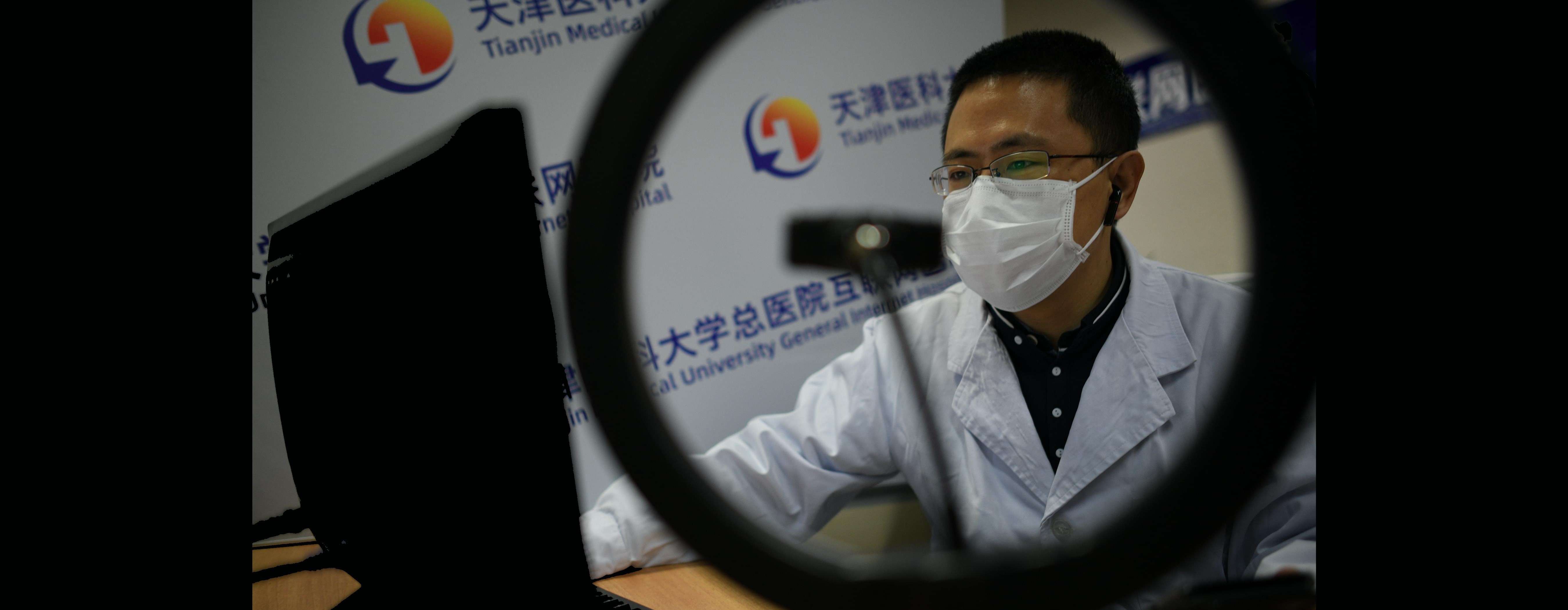

What the Covid-19 Episode Taught Us About China’s Healthcare System: Pros, Cons, Mistakes and Success Stories

From a wide range of perspectives, the COVID-19 episode can be considered an “Aha!” moment or, in other words, it taught us a series of (mostly harsh) lessons about the healthcare systems of various countries. The negatives have most definitely been in the spotlight, especially negatives associated with healthcare systems which were perceived as cutting

Jul

- No Comments

U.S. Social Media Companies and China

In a world that is growing more and more connected every day, it’s interesting to take a look at all of the different relationships between countries and private companies. Above others, the one industry that arguably leads in terms of influence is represented by, as many have most likely guessed… the social media sector. Social

Jul

- No Comments

(Why) Did China Handle the Coronavirus Situation Better Than the West?

Even when it comes to the worst calamities, pandemics included, the dust does eventually settle and once that happens, observers as well as (or especially) decision-makers need to put their rational thinking caps and dissect what happened over the past months in a manner as void of emotion as possible. What went wrong? What was

Jul

- No Comments

Luckin Coffee Case Study

There has recently been a fairly significant scandal involving one of the top companies in China. This company was being referred to as the Starbucks of China, however, after a surprising development, it came out that this company was forging sales and misleading investors. They forged online sales through their mobile app to make investors

Jul

- No Comments

How Can (Will?) China Jumpstart Its Economy After the Covid-19 Episode?

A thorough and most importantly brutally rational analysis of the economic effects of COVID-19 on China needs to be conducted with a cool head and while a valid case can be made that it is still too soon for us to claim that the dust has settled to enough of a degree for that to