During the 70s and 80s, interest in arts and antiques from the China region came primarily from Hong Kong and Taiwan. However, as time passed and mainland China became and more prosperous, the tide turned. Or, to be more precise, while there is still quite a bit of interest originating from Hong Kong and Taiwan,

Investment Opportunities

Oct

- No Comments

Risk and Money Management When Investing in China

One of the most common misconceptions among investors is that to succeed, you have to be right more frequently than you are wrong. That is hardly the case, whether we are referring to Chinese assets or any other asset class. For example, you can be right 9 out of 10 times and generate 1% each

Sep

- No Comments

To Short Sell or Not to Short Sell: Should One Short Chinese Assets?

In a previous article, we have made it clear that in China (most likely more so than in more established Western jurisdictions), both extremes of the investment spectrum are well-represented: from genuine long-term opportunities to more or less reckless short-term speculation options. Through this post, we will be taking a closer look at the latter

Aug

- No Comments

Should You Invest in China… Now? (If Not, When?)

One of the most common discussion themes among current and potential investors in China alike is represented by the timing element. In other words, is now the right time to back up the truck and invest in China or would it be wise to wait? As (pretty much) always when it comes to such broad

Jul

- No Comments

The Trajectory of Chinese Assets After the Next (Global) Financial Crisis?

If you were expecting this to be an article which starts out with questions and gradually works its way toward answers, you will be disappointed because we will be answering the question which constitutes the title of this post right from the beginning: the trajectory of Chinese assets after the next financial crisis will most

Jul

China’s Love/Hate Relationship with Bitcoin and Crypto

It’s impossible not to follow bitcoin and cryptocurrencies without noticing how important the Chinese variable is and has been, despite the authorities in China having little love for digital currencies. In other words, the “love” dimension of the relationship is represented by the fact that a lot of Chinese INVESTORS want to have bitcoin/crypto exposure,

Jun

China and Exotic Assets: From Domain Names to Cryptocurrencies

There are quite a few jokes floating around asset management circles about the lack of sophistication exhibited by the average Chinese investor compared to more experienced investors from the West. But… well, the joke is on them because this lack of sophistication is temporary at best and in some cases, such claims actually turn out

Jun

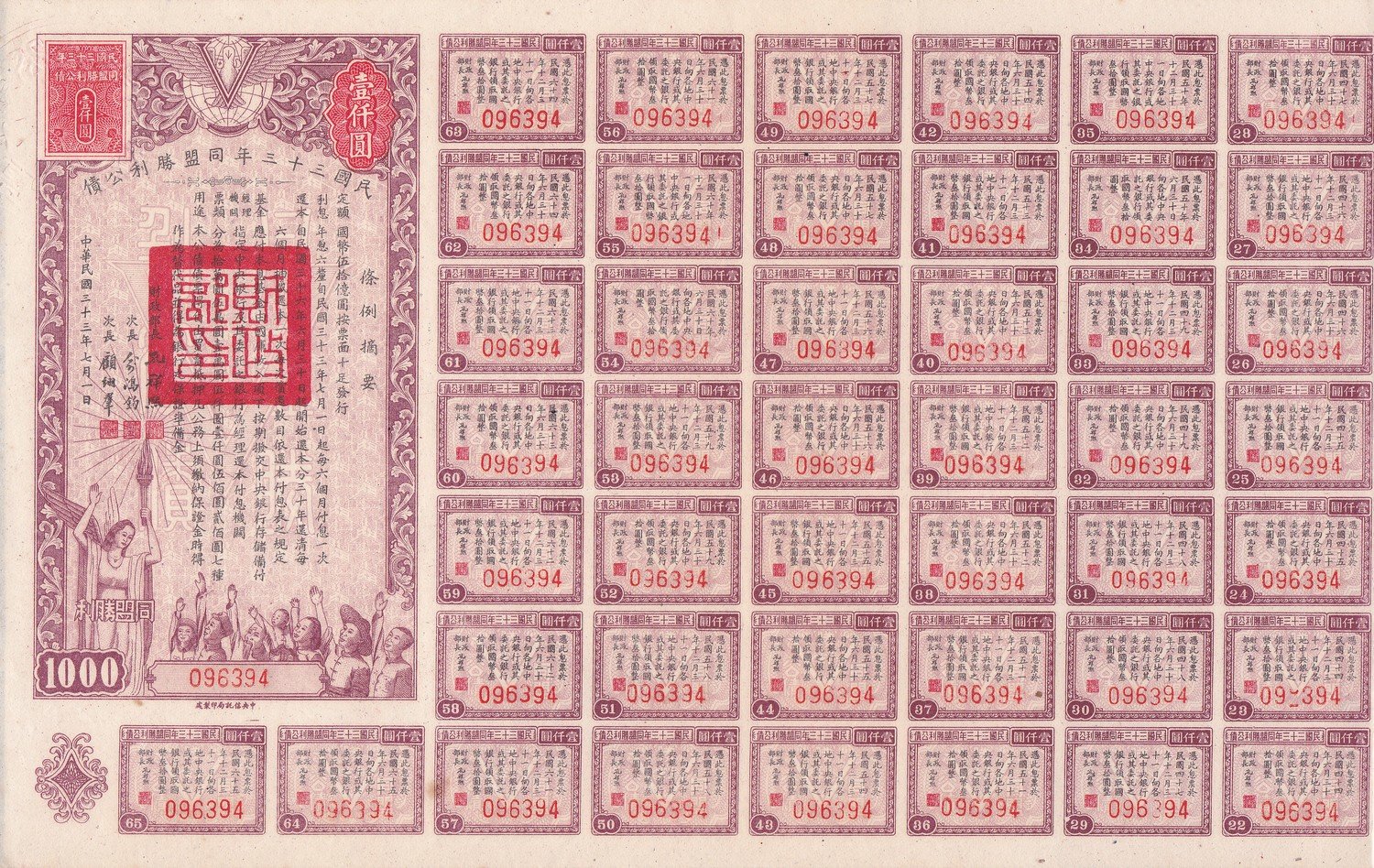

Should Chinese Bonds Be Considered Attractive?

In light of the fact that the yuan-denominated bond market is becoming an option for foreigners (with, for example, the Bloomberg Barclays Global Aggregate Index including yuan-denominated bonds as of April 2019), it makes sense to ask yourself if you should or shouldn’t try to grab a piece of such a huge pie, with roughly

Jun

- No Comments

Bullish on China = Bullish on Precious Metals?

As of the liberalization of the market back in the late nineties, Chinese investors have developed quite an appetite for gold and precious metals. According to the World Gold Council, their appetite has been so unquenchable that as of 2013, China became the world’s #1 market for gold. In fact, just like with many other

Jun

- No Comments

The Pros and Cons of Investing in Chinese Stocks

Are you a proud Amazon shareholder? Why not add some Alibaba Group Holding shares to the mix? Or perhaps you’re a huge Facebook fan and love buying their stocks… why not diversify a little bit and add some Tencent Holdings shares to your portfolio. Into Google rather than the previous two examples? Great… but why