The coronavirus is currently reshaping the world we live in. Odds are that regardless of where you live, you’ve been impacted in some way, shape or form. Even if you haven’t gotten sick, you’ve probably been forced to work from home or quarantine yourself inside your home. A staggeringly large number of individuals have seen

China Growth

Jun

- No Comments

Just How Serious Would a Recession Scenario Be for China… and Everyone Else?

The economic landscape is pretty much always dominated by a wide range of controversial topics and among them, a popular one tends to be that of recessions, with two broad sides being relatively easily identifiable. On the one hand, there are those who consider recessions bitter but necessary medicine (Austrian Economists, for example) and believe

Jun

- No Comments

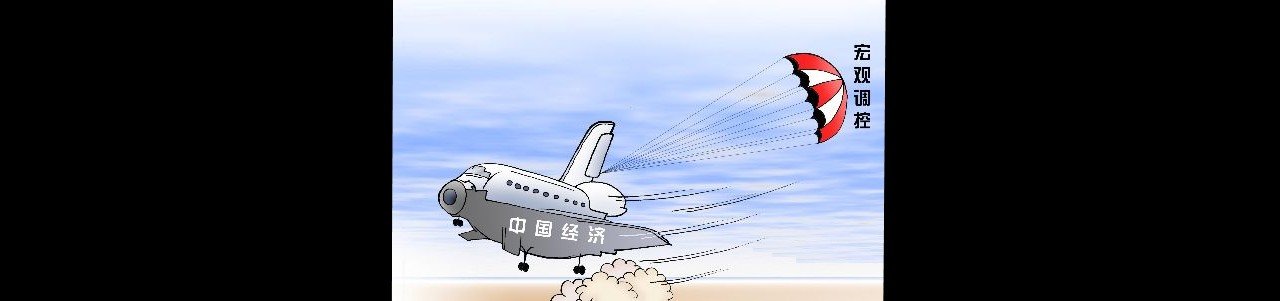

China’s Economic Growth Projection (5-10 years)

If you’ve been living in the U.S. for the past 10-20 years and keep up with the economy then chances are that China has come up in the conversation quite a bit. China is oftentimes considered the elephant in the room because they’ve been on an economic tear over the past several decades to rival

Jun

- No Comments

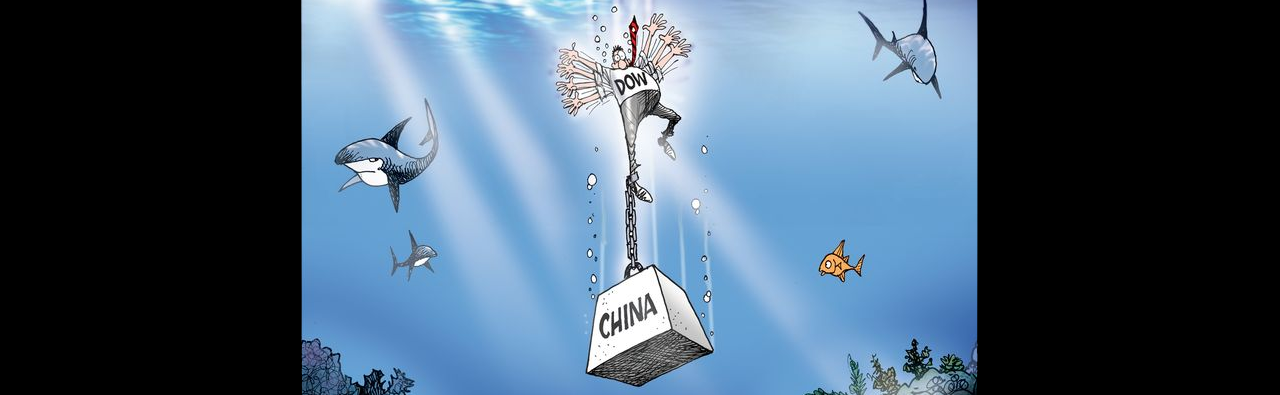

Hard and Soft Landing Scenarios for China in the Context of Unprecedented Economic Interconnectedness

If we eliminate the time dimension from the equation, it isn’t the least bit difficult to state (in a quasi-axiomatic manner), that whenever there are imbalances when it comes to a certain nation, the market will ultimately figure out a way to re-establish balance. For example, if a country is overly indebted, the market will

Jun

- No Comments

What the Market Capitalization (Market Cap) of Chinese Assets Does and (Especially) Doesn’t Tell Us

Time and time again, the market capitalization of a certain asset (from stocks to cryptocurrencies) is used as a (somewhat) misleading selling point by those interested in painting a bullish/optimistic narrative and the exact same principle is valid when it comes to Chinese assets. To put it differently, commentators interested in pushing a bullish narrative

Jun

- No Comments

Marxism-Leninism in China: Foundation or Ideological Ballast?

In light of the fact that the very first ideology of the Communist Party of China was Marxism-Leninism, many less than thorough investors make the mistake of believing that today’s China is run in the spirit of the ideology in question. Is that true? To put it differently, is socialism with Chinese characteristics perfectly in

May

- No Comments

Here Are 7 Ways You Need to Know That China’s Economy Is Changing with COVID-19

Over six months after China detected the first cases of the novel coronavirus, the world remains embroiled in this pandemic. So far, China has fared reasonably well, having comparatively few deaths and an astonishingly low number of cases (although, there are some in the Western intelligence communities that have questioned these numbers). Regardless of what

May

- No Comments

Understanding China FUD: Fear, Uncertainty and Doubt

It is quote common for there to be a quasi-permanent battle on all fronts between bears (those who believe a certain asset is overvalued and that prices will go down) and bulls (those who believe the exact opposite, that a certain asset will go up in value). Some bulls and bears have no skin in

May

- No Comments

“Predicting” Tops and Bottoms: Does Time in the (Chinese) Market Beat Timing the Market?

It is oftentimes considered quasi-axiomatic that “time in” the market (having exposure to certain assets) beats “timing” the market, in other words beats trying to predict tops and bottoms. Some market participants swear by this adage, others roll their eyes due to considering it so overly-used that it lost all substance. What does the ChinaFund.com

May

- No Comments

“Accumulating” Chinese Assets Is the Operative Word

In a jurisdiction as volatile but also potentially career-altering in terms of returns such as China, the sky is the limit when it comes to possibilities and approaches chosen by investors as well as traders. In fact, we’ve dedicated an entire article to just that: making it clear that there are anything from high-frequency traders