Jul

When it comes to China, one of the first things that you hear of when mentioning their economy is their amazing growth rate. The Chinese economy has doubled roughly every 8 years for the past 40 years. This level of economic growth is on par for one of the best in history and is obviously a key motivator for foreign investors to invest money in China.

That being stated, there are quite a few other reasons to start investing in China other than their growth rate. Whether you’re looking to open up a physical business or invest some money in Chinese companies, there are a lot of reasons to get started. Let’s take a look at a few of them.

5. Population Size

Right alongside their economic growth, China has had an explosion in population size. China currently has the world’s largest population, sitting at 1.4 billion people. India is close behind with 1.3 billion and the United States in third with 330 million. This means that despite being roughly the same size in terms of land, China’s population is roughly 3 times the size of the U.S. population.

If you’re an outside investor, this is good for a few reasons.

- Customer base – If you’re planning on opening your own business in China, there is no shortage of potential customers to buy your product. If you’re investing in a Chinese company, the same logic applies

- Labor – China has plenty of people available to help with production. This is one of the reasons why so many companies are opening up factories in China

Most investors will look at an opportunity for growth within a given industry or country over a longer period of time. The sheer size of China’s population means that it should grow across the board in terms of different industry sectors. For every one student that America has right now, China has 3, all of whom will grow up and contribute to the economy.

NOTE: Population size isn’t really meant to be a competition between countries. However, it can still play an important factor when making decisions and we have dedicated an entire article to explaining why.

4. Diversification

There is always a significant emphasis on diversifying when investing. You want to spread your money across different asset classes to make sure that you are protected. For example, if you put all of your money into one stock and that stock performs poorly, then you’re at risk of losing all of your money. However, if you spread your money out over 30 different stocks then you’ll be protected if one stock performs poorly because the other 29 might perform better.

Two concepts worth keeping in mind:

Diversifiable risk – This is risk that can be controlled by making sure your investments are adequately diversified

Non-diversifiable risk – This is risk from things that are outside of the investor’s control (like a war or a famine)

When it comes to your personal portfolio, your diversifiable risk can be reduced by investing in foreign countries and foreign currencies. Non-diversifiable risk would be something like Donald Trump’s trade war with China, which individual investors have no control over. The key is to minimize your diversifiable risk as much as possible.

So what does this have to do with investing in China?

Well, by investing in China you’ll be further diversifying your portfolio by having investments in a different country and exposure to a different currency. This means that if something terrible were to happen in the U.S. or with U.S. stock exchanges, then you’ll still have some money safely invested in another country.

By investing in a different currency (the renminbi), you’ll also be able to take advantage of potential fluctuations in currency values. For example, say that the Chinese currency experiences a positive trend in the currency appreciation market. If this happens, then the Chinese currency will be stronger during an inflationary cycle in comparison to the dollar and can offer better chances of survival to an investor investing in this market.

3. It’s Becoming More Mainstream

China has been viewed historically as the boogeyman over in the United States. Some investors are hesitant to invest money because they either see China as a direct threat to U.S. dominance or do not trust the communist government. However, in recent years, investing in China has become more and more popular. As that happens, there will be more transparency between Chinese companies and American companies.

Unfortunately, there have still been a few present-day instances of Chinese companies not being fully transparent. The most recent example happened with Luckin Coffee. Earlier this year, Luckin Coffee admitted that a good portion of their 2019 sales were fabricated through their online app. They artificially boosted sales through their mobile app to make it look as though they were more profitable than they were. When it came out that the sales were made up, the stock collapsed by about 75% before being halted on April 6th, 2020.

Situations such as this one are what make U.S. investors tentative to buy shares in foreign companies. Luckily, stories like these are becoming rarer and rarer. As investing in Chinese companies becomes more and more mainstream, there will undoubtedly be a more robust call for transparency from these companies. A move towards transparency will be better for everyone involved.

2. Government Incentives

China has long been known for the overarching reach of their government. It is not uncommon for the government to put officials on the boards of public companies or force companies to make decisions that are in the best interest of the country. Generally speaking, government intervention and entrepreneurship don’t go hand in hand. However, China actually has quite a few incentives to encourage people to open up new businesses.

If you’re a foreign investor, you might be well poised to take advantage of some of these incentives.

Here are a few:

- If you have a company or project that is focused on technology development, conservation of the environment, energy conservation or the discovery of new energy types, then you are likely to receive different types of tax incentives

- If you reinvest your profits in China, you’re likely to receive tax deductions

- Certain industries are exempt from paying business taxes. For example technology transfer, technology development and related services won’t need to pay as much in taxes

- Taxes on income earned by foreign enterprises though gains on stocks, interest, retirement pay, online work, and capital gains have recently been reduced from 20% to 10%

- To encourage small businesses and startups, the tax rate for small-sized businesses and new technology companies is just 20% instead of the standard 25%

Although some of these incentives don’t seem like the biggest deal breaker when it comes to starting a business, the fact that they were all implemented fairly recently is a good sign. Hopefully, due to their past success, China will continue to implement incentives for new entrepreneurs.

1. China Is Getting Back to Work

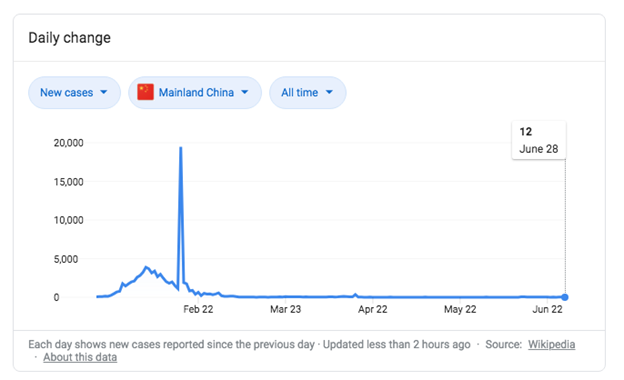

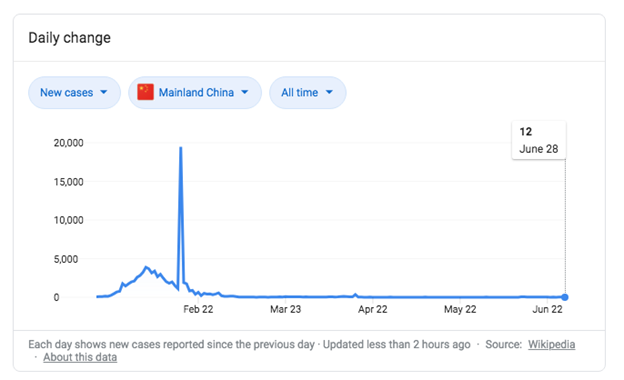

It wouldn’t be right if we ended this entire article without mentioning the coronavirus. As you have most likely heard, the coronavirus began in Wuhan, China and promptly raced through the population before going out into the rest of the world. However, at the time that this was written, it appears as though China has a good handle on the virus outbreak:

There are two things that come to mind when looking at this graph.

- China may not be disclosing all of their data about the virus. There is a WSJ article which argues something similar. Just by looking at the graph, it’s suspicious to have such a spike and dip so quickly for something like cases in a pandemic

- China did a particularly effective job of handling the virus outbreak

Most reports that have come out seem to point out that the truth is somewhere in the middle. Since China is a communist country, the government has much more power to enforce stay-at-home orders. Compare this to the U.S., where quarantine orders were treated as a suggestion until businesses were actually forced to close.

However, it does appear as though China is getting back to work. Following those strict quarantine measures, the coronavirus appears to be more or less contained in China. Most of their larger companies and around two-thirds of its small- to medium-size companies have gone back to work (according to China’s Ministry of Industry and Information Technology). It’s also a very good sign that the quarantine has been lifted in Wuhan (the place responsible for the outbreak in the first place).

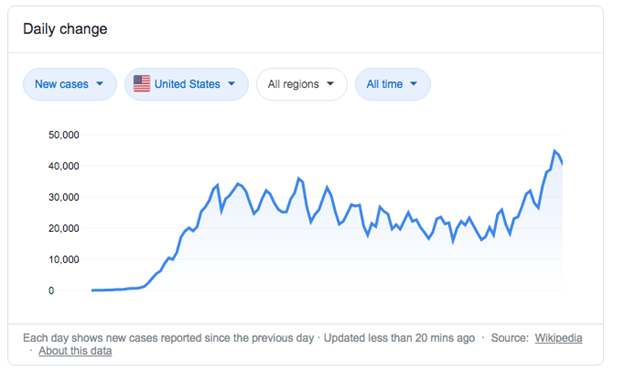

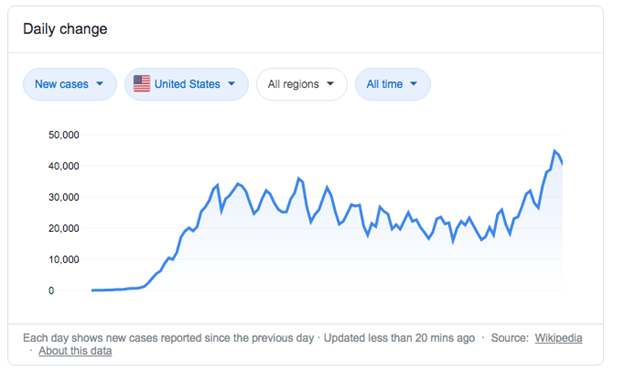

The quick return to work will be good for China’s domestic economy and for local consumer confidence. The quicker the spread of the virus can be curbed, the sooner everyone can return to work. The U.S., on the other hand, recently reported a record-breaking number of new cases.

We hope that you’ve found this article valuable when it comes to understanding a few reasons to invest in China besides their amazing growth. To read more, we would strongly recommend visiting our “New Here” section and to get in touch with our team of experts for consulting-related requests, our Contact section can be used.