Jun

The economic landscape is pretty much always dominated by a wide range of controversial topics and among them, a popular one tends to be that of recessions, with two broad sides being relatively easily identifiable. On the one hand, there are those who consider recessions bitter but necessary medicine (Austrian Economists, for example) and believe that in the mid to long-term, the authorities (governments and central banks) would be doing more harm than good by interfering in the economy so as to combat recessions. On the other hand, we have thinkers such as Keynesians who believe that on the contrary, swift action by governments and central bank is crucial, with them stepping in to fill the void left by the fact that the private sector is experiencing difficulties.

As can be seen, a “set in stone” conclusion when it comes to this topic is quite unlikely, with economists having attitudes in a spectrum which ranges from considering recessions good to considering them systemic threats which need to be combated immediately. At this point in time, an attitude closer to the latter tends to be more prevalent among governments and especially central banks.

But what are recessions anyway?

It… well, depends on whom you ask.

If you ask those in the let’s call it financial media business (journalists, influencers, etc.), most of them will say something along the lines of two consecutive quarters of inflation-adjusted economic decline being necessary for them to use the “recession” term and it does make sense from a talking point perspective. Economists however have a more complex manner of seeing things, with monthly business cycle peaks and troughs being used, peaks and troughs based on NBER (National Bureau of Economic Research) data.

The bottom line is this: for the most part, a recession can be considered a (relatively short) period of economic decline, higher unemployment, lower industrial outputs or, generally speaking, economic deterioration on multiple fronts. If we end up dealing with a very extended recession, debates start popping up as to whether or not we are in depression territory, but that is a topic that goes beyond the scope of this article.

Moving back to recessions, how serious would that be for China?

Furthermore, would a Chinese recession ultimately end up impacting the global economy to a significant degree?

As far as the first question is concerned, in a framework where we merely apply simple logic and one that is based on the assumption that economic growth has been reasonable and sustainable over the years, a recession is hardly the end of the world.

In today’s over-leveraged and overly-derivative-exposed world, however, the situation is anything but straightforward.

Why?

Primarily because leverage and derivatives don’t exactly have the habit of going hand in hand with sustainability. To put it differently, an economy that is genuinely sustainable on all fronts would be able to relatively easily recover after scenarios which involve let’s say defaults of several important companies. Yes, creditors would stand to lose money and yes, shareholders would be anything but pleased but in the grand scheme of things, the economy would be fine.

In a world dominated by high-leverage derivative bets, the elephant in the room is represented by the fact that on top of each product such as shares, there lie mountains of more or less toxic products involving high-leverage derivatives bets and the holders of those products would be extremely exposed as well. From banks to insurance companies (as the Great Recession made clear), this (over-)exposure would most likely lead to a chain reaction of insolvency-related situations which would ultimately result in the financial system grinding to an abrupt halt.

Therefore, a valid case could be made that, unfortunately, recessions tend to be more systemically dangerous than in the past, especially for a country such as China that has structural problems of its own (malinvestment, excessive corporate debt, an equity sector that relies too much on less than sophisticated retail investors, etc.).

How would the rest of the world fare in the event of a Chinese recession?

More likely than not… well, poorly.

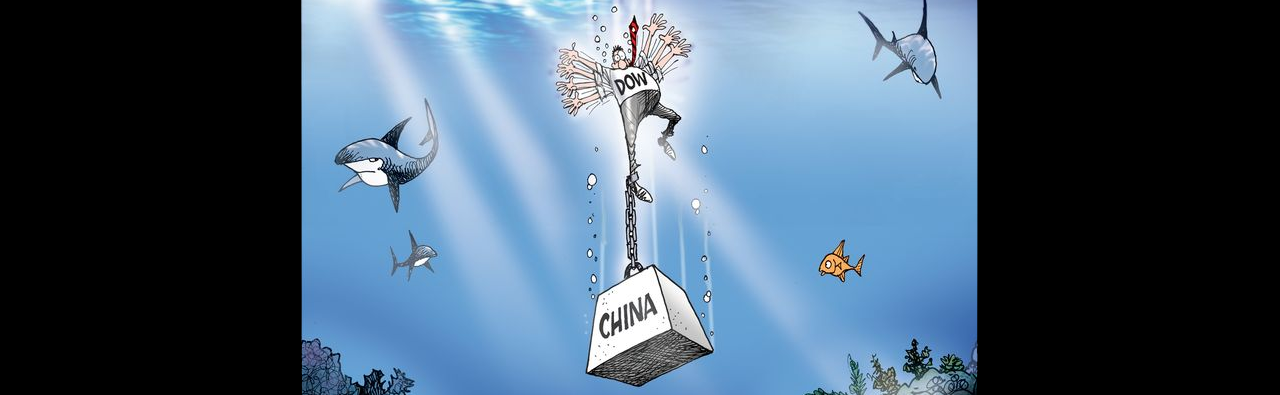

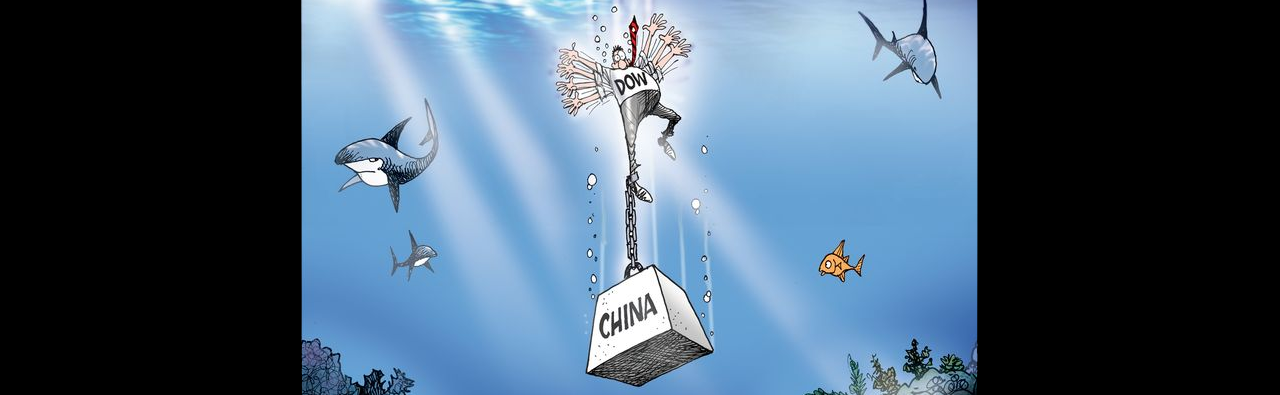

Again, economies are considerably less insulated than in the past in 2020 and beyond and as such, whenever a country such as China (the world’s number two economy in nominal GDP terms, the number one importer of commodities… the list could go on and on) sneezes, it is more than reasonable to assume that a wide range of other sovereign economic actors will catch a cold.

The idea that in true Schadenfreude fashion, China will crash and burn whereas its “adversaries” will thrive and rub their hands greedily as they watch the entire process is naïve at best. For example, how likely is the United States to greedily rub its hands in anticipation of the proverbial good times that are ahead knowing that China holds a huge inventory of US debt that if unloaded on the market in a less than orderly fashion, risks triggering a sovereign debt tsunami? Not very likely, we are sure you would agree.

A fairly straightforward conclusion is therefore this: due to the unsustainable nature of 2020’s financial systems, countries from China to the United States look at recessions and potential recessions with extreme fear, knowing that their more than fragile systems are only one endogenous or exogenous shock away from showing their limits. The same way, yes, various countries consider other nations economic adversaries but to believe that they would wish a recession upon the adversaries in question is nothing short of reckless… they would most definitely not, knowing that a systemically dangerous economic calamity affecting an adversary is quite likely to lead to a “mutually assured (economic) destruction” scenario.

As complicated as all of this may seem and indeed is, wrapping your head around today’s overly-sophisticated yet overly-vulnerable financial systems is a must if you are serious about having staying power as an investor and, of course, the ChinaFund.com team is here to help you with just that.