Jun

If you’ve been living in the U.S. for the past 10-20 years and keep up with the economy then chances are that China has come up in the conversation quite a bit. China is oftentimes considered the elephant in the room because they’ve been on an economic tear over the past several decades to rival the United States.

Despite being one of the world’s oldest countries, they have never been thought of as an economic powerhouse. However, since they opened up their economy to foreign trade and investment in the 1980s, they’ve seen an incredible spike in growth. As an investor, you’re probably wondering if this economic growth is sustainable. It’s been almost 40 years of China just growing and growing. Are they similar to a stock that hits a record high every day and is overvalued? Have you missed the boat when it comes to investing in their economy?

This is China’s economic growth projection for the next 5-10 years.

China’s Economic History

To get a good idea of how much they’ve grown and put it in the right context, we need to take a look at their history. The information and statistics for the following section have been sourced from a report by the Congressional Research Service.

China Pre-1980

In a nutshell, China’s economy can be summed up as very stagnant prior to 1979 and rapidly expanding in the years since. Pre-1980, China’s economy was very much removed from the global economy and the government didn’t allow for global trade or outside investment.

While under the leadership of Chairman Mao Zedong, China operated under a centrally planned economy (also referred to as a command economy). This means that the majority of the economic output was controlled by the state. The state was in charge of production goals, prices, and how/where resources were used. In the years prior to 1979, all corporations were considered state-owned enterprises (SOEs) and private enterprise or foreign-investment companies were banned.

The thinking behind this type of system was to ensure that China’s economy was self-sufficient and didn’t rely on foreign companies. The only major import was represented by raw materials that could not be found in China. These materials would then be used to create other goods.

However, this system is generally not the most efficient, as it removes various types of incentives.

For example, since the government set production goals, business owners only cared about meeting those goals and not necessarily about producing as much as possible. Profits did not increase with production. Additionally, since goods were not sold on a free market where there is competition, workers had no reason to care about the quality of their output.

Economist Angus Maddison puts China’s actual average annual real GDP growth during this period at about 4.4%.

China’s Trade Relationship With the U.S.

China’s growth can be closely tied to the United States from 1980 to the present day, as the United States was one of its top trade partners. Trade grew from $5 billion in 1980 to $660 billion in 2018. Currently:

➢ China represents the U.S.’s largest merchandise trading partner, its third-largest export market, and the #1 source of imports

➢ Many U.S. companies have large operations in China to take advantage of the booming market as well as low-cost labor (Nike and Apple are two examples of companies that do quite a bit of business in China)

It’s interesting to note that China’s transition from a centrally planned economy to one with a more significant focus on entrepreneurship is generally accepted as the main reason why their economy has expanded so much. The idea that entrepreneurial countries grow the fastest is a central argument in Yuval Harari’s Sapiens: A Brief History Of Humankind. It’s also one of the main reasons behind the United States’ growth (7 of the top 10 largest companies in the world are from the U.S.).

1980 and Beyond

Starting in 1979, the Chinese government began invoking economic reforms to try and spur growth. The three major reforms were:

- Price and ownership incentives for farmers. This allowed them to sell a portion of their crops on the free market (introducing an incentive for farmers to produce more)

- The establishment of 4 economic zones on the coast. These zones were meant to attract foreign investment, boost exports, and import technology

- Decentralizing economic policy-making – This was done in waves over the next couple of years

These reforms and the general decentralization of the economy overall have allowed China’s real GDP to grow at an average rate of 9.5%. To say this another way would be that the Chinese economy has doubled approximately every 8 years.

So where has all this lead China?

Where Is China at today?

According to the New York Times, China’s economy shrunk for the first time in approximately 50 years. However, this may have been mainly due to the impact of the coronavirus, which shuttered about 460,000 Chinese firms during the first part of 2020.

Additionally, despite their tremendous growth, China now has fresh problems to deal with which are mainly in the form of income inequality:

➢ Per capita income is only about a quarter of that found in high-income countries

➢ Approximately 373 million Chinese are living behind the upper-middle-income poverty line of $5.50 per day

➢ China’s growth was spurred by resource-intensive manufacturing and low-paid labor. This involves a lot of citizens working in factories but not earning very much for their hard work. Many U.S. companies have been criticized for using labor in other countries due to it being available at cheaper rates, wage arbitrage in other words

China has achieved one goal of economic growth but will now have to become more structured and focus on addressing new issues that have been created due to that economic growth. Additionally, because they are now a much larger economic force than previously, they are held under closer scrutiny from a global perspective. For example, they will now be expected to adhere to global environmental standards (they’re currently the largest emitter of greenhouse gases in the world).

COVID-19 and China

Just like all countries right now, China will have to determine how they will deal with the health and economic impact of the novel coronavirus. It represents a larger problem for China than most other countries due to the fact that the coronavirus is believed to have its origins in Wuhan, China. Here are just a few manners in which the Chinese economy will suffer from coronavirus-related consequences (and will continue to suffer in the coming months)

- Containment measures to prevent the spread of the disease put hundreds of thousands of workers far from factories

- Containment measures (mainly social distancing) mean that people will be staying at home and spending less money shopping. This will translate to smaller profits, even for essential businesses

- Many of the medium-sized businesses in China are financed in ways that make them unable to receive bailouts from central banks

- There is still the threat of a resurge in coronavirus cases which will lead to another recession

China’s Economic Growth Prediction: 2020-2030

Short-Term (2020-2025)

If we were to flashback to the beginning of this year and write this article pre-coronavirus, it would probably state something entirely different. The introduction of the coronavirus to the world will have severe impacts on the global economy (and especially China’s) for years to come. These effects will likely be so widespread that any previously written projections are better off thrown out. The ability to make predictions is also generally limited by the information provided by the Chinese government (which is historically optimistic and unreliable). However, to give you an idea of just how difficult the economic woes are in China, the Chinese government refused to release a target for economic growth for this year. This hasn’t been done since China started publishing a report in the 1990s. It is essentially an admittance of how dire the situation is.

Additionally, the employment deterioration in China is also quite drastic. The unemployment number that China reported in April came in at 6% (close to a historical high). However, the think tank Capital Economics believes that the “true level of unemployment is likely double this given that around a fifth of migrant workers haven’t returned to the cities.”

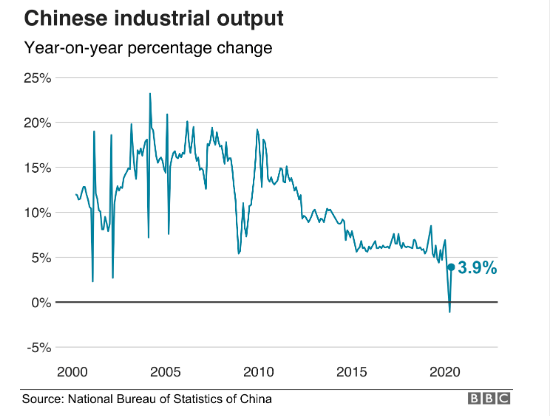

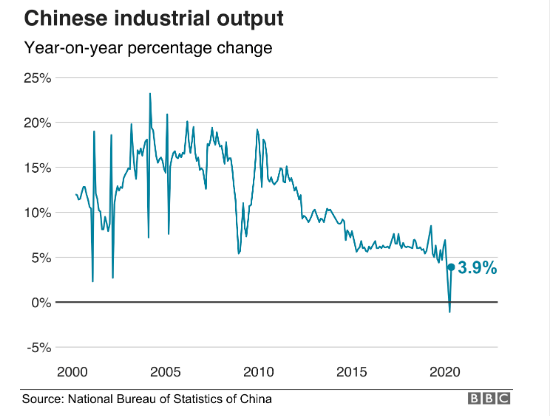

China is clearly still struggling with the repercussions of coronavirus. However, it’s not all doom and gloom. In April for example, industrial output actually grew by 3.9%, which could indicate (as you can see on the graph below) that the situation has bottomed out.

Long-Term

The long-term projections for China will also be reliant on whether or not the country is able to stage a sufficient recovery from the coronavirus and what will happen it doesn’t.

It’s interesting to note that the Communist Party of China has made promise to its citizens for the past 40 years. The promise was this: we’ll keep your quality of life improving and you fall in line so that we can keep China on the right path. 2020 was meant to be the year during which China would eliminate poverty and raise the standard of living for millions of people. The pandemic is obviously disrupting those plans and now millions of people from younger generations will not be guaranteed the same degree of success that their parents had.

The future of the Chinese economy is literally unfolding over the next couple of months.

What does this mean for you as an investor?

Here’s what we do know:

➢ China still has the world’s largest population

➢ China has been growing every year for the past 40 years

➢ China represents the world’s second-largest economy

➢ They’re struggling greatly with the coronavirus (from both a health and economic perspective)

As an investor, fortune favors the bold. Of the three takeaways listed above, 3 of 4 are positive. Eventually, the repercussions of the pandemic will settle, as herd immunity perhaps grows (although there are no certainties in this respect given the novelty of the virus) and vaccines as well as various types of medication are manufactured. When that eventually happens, the Chinese economy will come roaring back.

People who invested during the peak of the Great Recession or Great Depression made a killing. Investors who take similar action during the peak of Chinese distress are poised to do the same.

We hope that you’ve found this article valuable in understanding a little about China’s economic history, where they are at today and where they’re headed. If you’re interested in reading more, please head on over to our New Here section and should you or your organization require a more personalized touch, simply send us a message through the Contact section of ChinaFund.com and we will get back to you as soon as possible.