Jul

Quite a few people are looking to start investing in China, however, it can be tough to know where to begin. After all, if you don’t live in China and most of their companies haven’t made it to the United States market, how are you supposed to have heard of them?

To help give you a few potential starting points, we’ve gone ahead and selected our three favorite Chinese investments as well as a few reasons why we like them. Each investment will feature a few qualitative reasons why we like them (such as industry or consumer trends) as well as quantitative reasons (numbers pulled from their annual reports).

Without further ado, let us move on to our three favorite Chinese investments.

NOTE: This article is for informational purposes only and is not meant to act as financial advice.

It’s no secret that the world has been transitioning toward eCommerce for years now.

First, there is a very well documented decline when it comes to traditional retail businesses (formally known as the retail-pocalypse). While not all of these bankruptcies are 100% attributable to the rise of eCommerce, that has definitely played a major role. By “retail-pocalpyse” we just mean that consumers have been shifting toward online shopping. They like to buy products from the same store online or from a site like Amazon as opposed to actually going to the physical location and buying things.

Companies that don’t have a seamless online shopping experience have been falling behind or closing up shop altogether.

Some of the most recent store closures have been from:

➢ Neiman Marcus

➢ Diesel

➢ Toys R Us

➢ Forever 21

➢ J Crew

Click here to read a more exhaustive list.

An important question arises: if most or even all of the retail businesses are (eventually) closing, does that mean that people aren’t buying as much stuff anymore? Or does it mean that people are still buying stuff, just that they’re buying it online?

As common sense most likely dictates, people are still buying (at least) the same amount of goods, they’ve just been transitioning to eCommerce for the bulk of their purchases. Some people have even started to order things like their weekly groceries online and get them delivered straight to their homes.

Let’s take a look at a few stats behind eCommerce:

- The global eCommerce rate for 2020 is expected to come in at 19%, to bring total eCommerce sales to around $4.206 trillion globally

- ECommerce market share of total retail transactions is expected to double from 10.4% in 2017 to 20% in 2023

- Over 15% of all sales are expected to take place online over the next year

Not only are these numbers impressive from a global standpoint but the best part is that Asia-Pacific is by far the largest region for eCommerce (according to Oberlo.com).

If you think eCommerce is popular in the U.S., it should represent great news for you that it’s far more popular in Asian countries.

Additionally, with the introduction of the Coronavirus earlier this year, this trend toward online buying/selling will only be accelerated over the coming years. People are being forced to stay home and quarantine themselves while businesses (which aren’t considered essential) are forced to shut their doors down. This means that for lots of people and businesses, there is no alternative except resorting to doing things online! It’s the only way that they’ll be able to continue functioning.

Companies that have been holding out on transitioning to eCommerce will be forced to adapt in order to stay relevant.

For just these reasons alone, any company that dominates in eCommerce could be considered a solid investment. With that being stated, let’s take a look at one of the top players in China when it comes to eCommerce: JD.com.

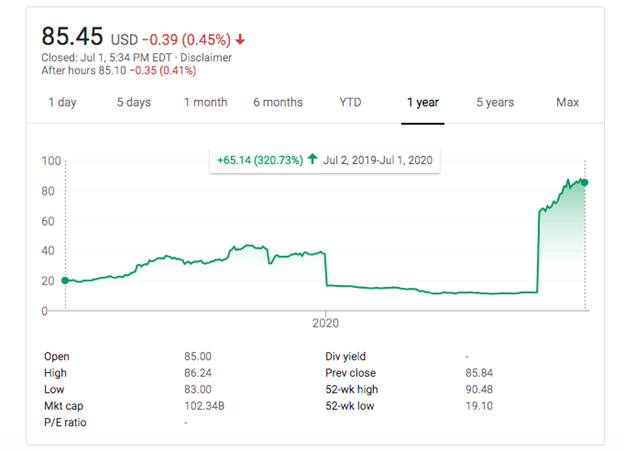

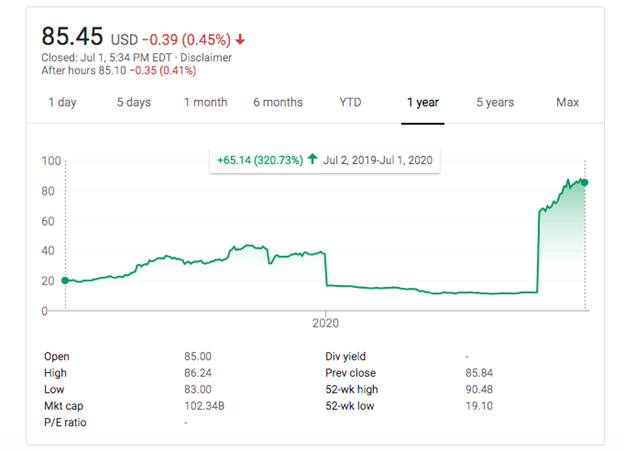

JD.com is a leading technology-driven e-commerce company that wants to become the number one supply chain based technology and service provider. They’re the second-largest eCommerce company in China (after Alibaba) and pride themselves on their cutting-edge retail infrastructure that offers what they call Retail-as-a-Service (offering to let other companies use their platform to sell products). They’re currently the largest retailer in China and a member of the NASDAQ100 as well as Fortune Global 500.

After taking a quick look at their 2019 Annual Report:

➢ Net revenues have been steadily increasing since 2015

➢ 2019 was the first year that they operated at a profit

➢ They’ve been investing heavily in research and development

At a glance, JD.com is a company that could be poised to drastically grow their business over the coming decade. They’ve been making more and more money each year, have the capacity to earn a profit and are investing money back into their business.

Our next company is another eCommerce player:

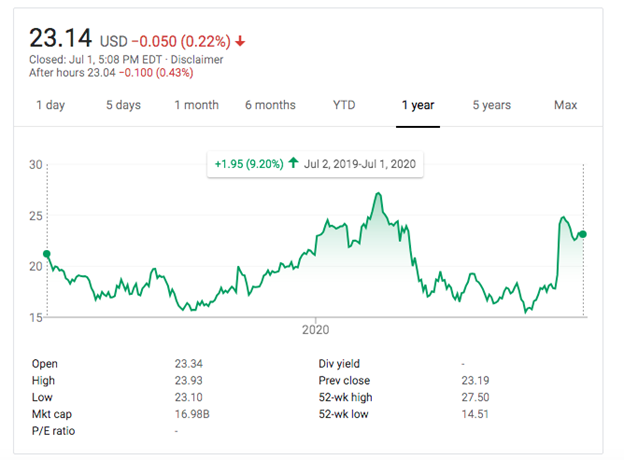

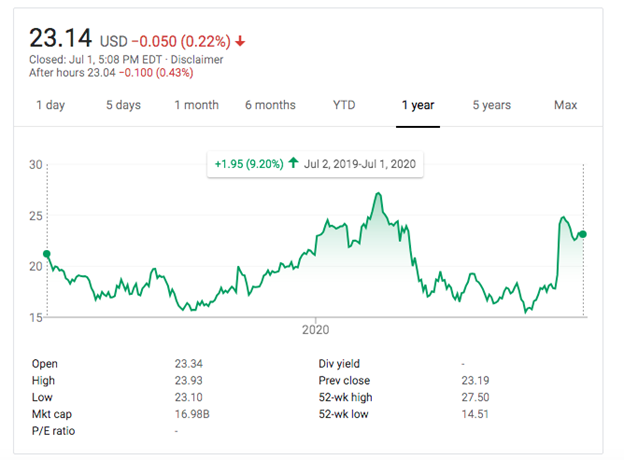

We feel so strongly about the rise of eCommerce that our second company is another eCommerce sector entity. The reason why we have decided to put two companies in the same industry in the spotlight primarily revolves around the coronavirus. Over the next couple of months/years, late adopters of eCommerce will be forced to make the jump. This will be good for companies such Pinduoduo which help other companies sell online.

The same information from the previous section is going to apply to this one.

However, Pinduoduo has a distinct advantage built into their platform, which is why we like them as opposed to other companies.

Competitive Advantage: Pinduoduo’s platform encourages users to invite their friends to purchase the same products. In this sense, they encourage “group buying”. This is a huge advantage when it comes to driving growth because people want to do what their friends are doing. This same mentality is what helped companies like Facebook and TikTok achieve their amazing growth.

Let’s take a look at their 2019 annual report.

Key takeaways:

➢ Their revenues are growing exponentially (growing by 6 times in just 4 years)

➢ Their top expense by far is marketing. This is a good thing because they’re putting a lot of money into gaining customers over competitors and this expense can be cut at any time

Additionally, highlighted in their annual report were the following advantages:

➢ The ability to attract and retain merchants

➢ The ability to seamlessly connect with social media networks

➢ The fun and interactive shopping experience of their platform

Just like JD.com, Pinduoduo is an exciting company in a rising industry that is poised to take advantage of what should be a fruitful decade for their company. We wouldn’t be surprised if they dethrone Alibaba or JD.com to become the region’s top eCommerce player over the next few years.

IQiyi is a leader in streaming content online and has often been referred to as “the Netflix of China”. They’re poised to take advantage of the growing trend among consumers to stream content from home as opposed to going out to theaters. This is another trend that will likely be accelerated because of the closing down of traditional theaters due to the coronavirus.

Although this trend is already pretty mature in the United States, it still stands to grow because people are being forced to stay home due to the pandemic. This could lead to more people picking up streaming when they were previously holding out.

In fact, you could argue that streaming was already becoming more popular over the past couple of years with companies such as Disney and Amazon launching their own services fairly recently. Media companies have seen how popular it has become and want to lure users to their own platform. What we are seeing now is a battle for popular content.

We took a look at their annual report from 2019 and here are a few takeaways:

➢ 100.5 million users

➢ $1.1 billion in revenue

➢ Membership increased 21% year over year

➢ Looking to expand out over SE Asia

IQiyi is currently operating at a loss but much of that is attributable to its expenses in creating new content and attracting new users. Creating new content, just like the current streaming wars in the United States, will ultimately be one of the deciding factors of who succeeds in this market. Netflix realized this early on when Disney reported that they will be launching their own streaming service (and taking content/users away from Netflix). IQiyi seems to be doing the same thing.

In Summary

If you’re looking to invest in China but aren’t sure where to start, a good starting point is to pick industries that you’re already familiar with. ECommerce and streaming are two of the fastest-growing industries in the United States, so it makes sense that they would be growing in China as well. Additionally, these industries will not be negatively impacted by the effects of COVID-19 and, if anything, their businesses will be better off.

We’ve looked at 3 stocks:

- JD.com – The 2nd largest eCommerce platform in China

- Pinduoduo – One of the stickiest eCommerce platforms in China

- IQiyi – One of the fastest-growing streaming services in China

Your investment decisions are your own but if you need a good jumping-off point, we’d recommend taking a closer look at these three companies!

We hope that you’ve found this article valuable when it comes to understanding 3 Chinese investments that you could potentially take advantage of. If you’re interested in reading more, please check out our blog as well as the “New Here” section of ChinaFund.com.