Jun

If we eliminate the time dimension from the equation, it isn’t the least bit difficult to state (in a quasi-axiomatic manner), that whenever there are imbalances when it comes to a certain nation, the market will ultimately figure out a way to re-establish balance.

For example, if a country is overly indebted, the market will ultimately punish it in one way or another. The same way, if a country is experiencing demographic decline problems which put pressure on its long-term economic growth potential, the market will ultimately punish it in one way or another… the list could go on and on.

However, “ultimately” is the operative word because human beings tend to be terrible at predicting the future and as such, it is impossible to know when the market will eventually re-establish balance. Moving on to the “how” dimension, while it is possible to at least put forth an educated guess with respect to how you believe the market is likely to punish a certain economic actor, it is a difficult endeavor but nonetheless, not impossible.

So, HOW can the market punish a nation?

Broadly speaking, there are two options:

- The “hard landing” scenario which involves a brutal and rather quick shakedown, for example a deflationary crash which wipes out “paper wealth” quickly by generating an asset price collapse (with the Great Recession being an obvious recent global example to that effect) or an inflationary spiral which involves the currencies of a certain nation taking a major hit rather quickly (for example, the 1997 Asian Contagion which started in Thailand and as the name suggests, ended up spreading to other nations)

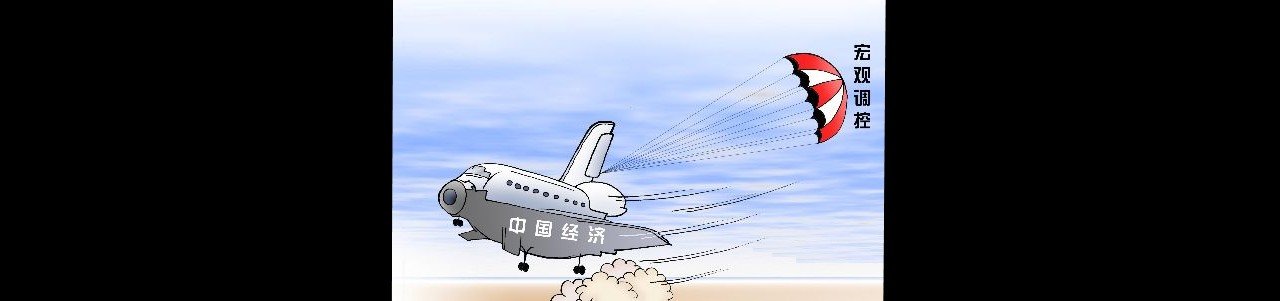

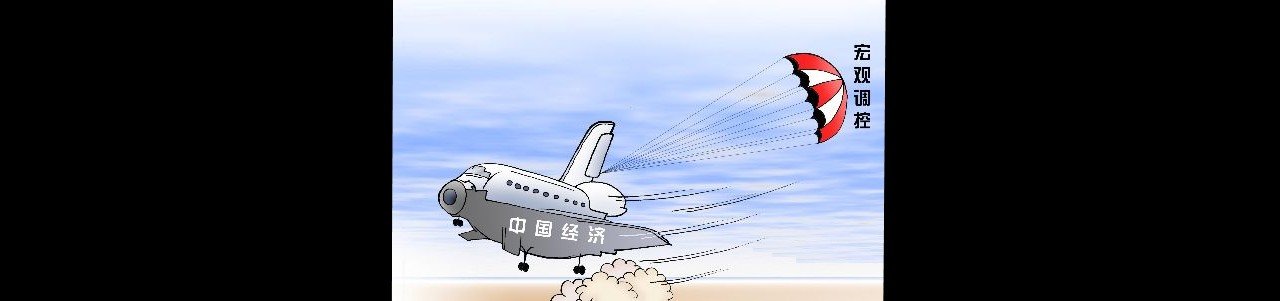

- The “soft landing” scenario which involves let’s not say death by a thousand cuts but rather pain/correction by a thousand cuts. Perhaps the most (in)famous example of this nature is represented by what started out as Japan’s lost decade and turned into Japan’s lost decades (plural), lost decades which came as a result of Japan’s major demographic problems, with the aging of its population and depressed natality levels representing a negative force which acts as an anchor, hindering economic growth and bringing about sub-par economic development over a period of not years but yes, downright decades

Which option would be more likely in China’s case?

Once again, we can consider two broad approaches which start with different underlying ideas:

- In light of the fact that China represents the world’s #2 economy in nominal terms, some experts believe there are more than enough forces at play which will act in a manner conducive to a soft landing scenario. Why? Simply because in light of the record-breaking global economic interconnectedness we are experiencing, pretty much everyone can be considered a stakeholder in this equation. To put it differently, if China were to experience a hard landing, it would be childish at best and reckless at worst to assume it can be “contained” and that no contagion will be generated. While nothing is 100% certain, the ChinaFund.com team is as close to being 100% certain as possible that a Chinese hard landing would bring about a global financial crisis. Therefore, a valid case could be made that the international community will do everything in its power to aid China with respect to avoiding anything that even resembles a hard landing, not due to its magnanimous nature but rather because other nations need ample time to prepare and want to avoid being caught off-guard

- In light the fact that China still isn’t what one could call a fully developed nation in every sense of the word (as indicators such as its less than stellar GDP per capita make clear), however, we need to take the very realistic possibility into consideration that China could lose market access (relatively) quickly. To put it differently, while Japan (with its ~250% public debt to GDP ratio) was granted the luxury of being allowed to drag its proverbial feet for not years but decades, the market might not be as “kind” to China. This scenario is definitely not impossible because while nations and leaders might want to do everything possible to avoid a hard landing, individual investors might decide to panic sell nonetheless to enough of a degree to make a hard landing unavoidable

Which scenario would be better for China?

While we have pretty much established that for other nations, a Chinese soft landing would be preferred, opinions differ when it comes to China itself. There are experts who believe a hard landing could lead to bitter but necessary medicine being administered to the Chinese economy and that after drawing the line, China would be better off this way as opposed to dragging its feet throughout multiple years of mediocrity… this would most likely be an approach “recommended” by those who strongly believe in letting market forces prevail, for example strongly right-leaning economic thinkers such as libertarians. On the other hand, there are also experts who believe this “bitter but necessary” medicine would be too much to handle for an over-leveraged (especially at the corporate level) China and as such, that a soft landing scenario would represent a better solution.

As always, the ChinaFund.com team believes in having all bases covered and would therefore strongly recommend preparing for both outcomes, with the main goal revolving around putting together a strategy that enables you to land on your feet under a wide range of scenarios. Betting the proverbial farm on just one horse is never an approach we’d recommend and on the contrary, we consider it anything but conducive to longevity as an investor/trader… call us old-fashioned but we firmly believe in acting with the big picture in mind and happily put our expertise at the disposal of clients who share our belief system as well as values.