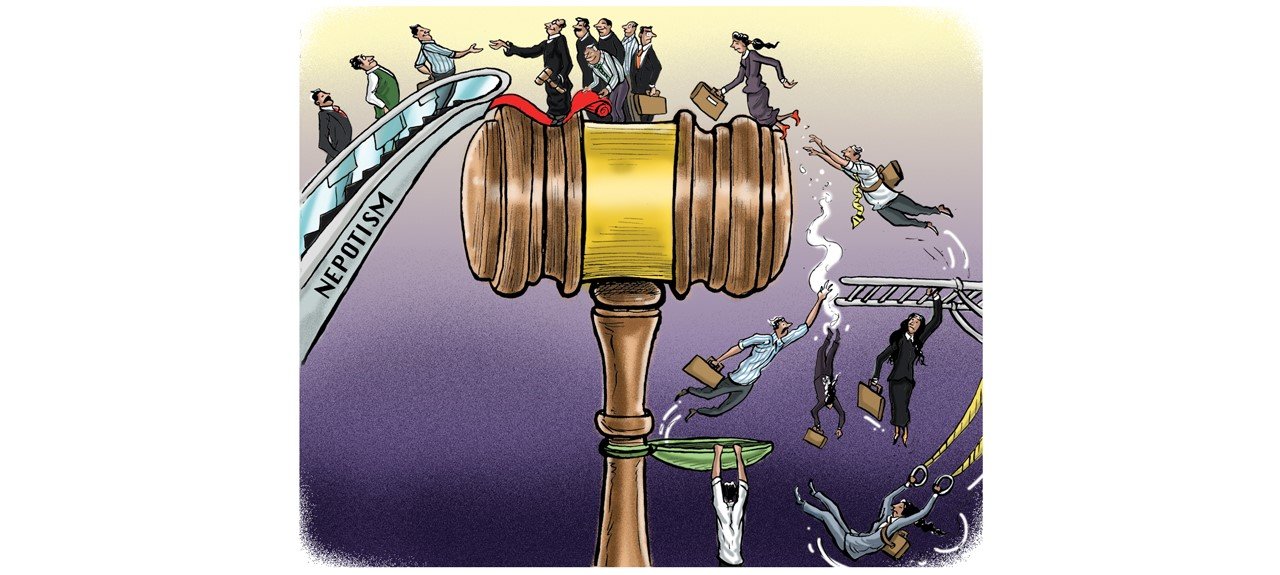

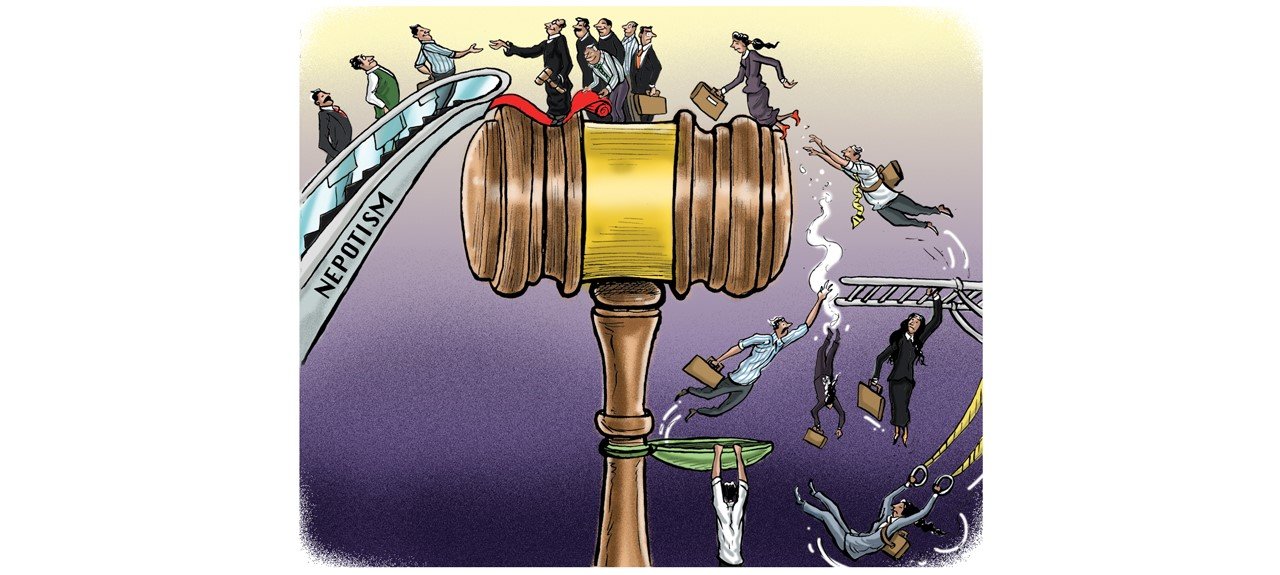

Feb

Western investors have varying reactions to… let’s call them certain Chinese realities. Issues pertaining to nepotism most definitely do not represent exceptions. It ultimately does depend to a significant extent on their country of origin. To give a few examples pertaining to Europe: someone from Northern Europe may find any kind of nepotism unacceptable, a Southern European will most likely not necessarily approve of this behavior but at least tolerate it, whereas someone from Eastern Europe would feel right at home (and this is coming from an economist who grew up in Eastern Europe back in the nineties).

At the end of the day, the ChinaFund.com team believes it is always wise to have rational expectations with respect to China. While there has been tremendous progress across a wide range of dimensions of the Chinese economic and even cultural landscape, it would be overly-optimistic at best and closer to childish to assume that multi-generationally ingrained nepotism is something that can simply be erased from the Chinese status quo.

The same principle is valid when it comes to topics such as corruption. Yes, it would be in the best interest of all stakeholders involved in the Chinese equation (including or especially Western players) if cultural plagues such as nepotism or corruption could be eradicated but past performance across a wide range of other jurisdictions and simple common sense pertaining to human nature tell us it is easier said than done.

The Xi Jinping administration has been especially vocal when making it clear that nepotism and corruption will no longer be tolerated and measures have indeed been undertaken (in the military sector for example, with ramifications we have covered through an article which can be accessed by clicking HERE) to combat both.

Have there been results?

Yes.

Is there a legislative framework in place for a downright war on nepotism to be possible?

Yes.

However, do keep in mind that despite there being results which have received extensive coverage in China (through its propaganda machine, some might argue) and despite there being a decent enough legislative framework in place, law enforcement when it comes to “tricky” and deeply ingrained aspects such as nepotism is anything but a walk in the park.

A valid case could be made that other than a few “poster boy” examples meant to manipulate the public into thinking nepotism and corruption can be eradicated in a relatively short time frame, there is ample evidence in “deep China” (less developed, especially rural, regions) that there is a major gap between state-owned or controlled media headlines and the realities of China.

Are we stating that it cannot be done in China?

No, we are simply pointing out that it cannot be done as a “one generation” approach. Nepotism is something that needs to be gradually phased out, one generation at a time, each with a slightly more nepotism-adverse cultural Zeitgeist than the previous. Assuming the authorities can simply snap their fingers and make nepotism a phenomenon of the past is not just a logically inconsistent endeavor, it also carries a high dose of hypocrisy if it originates from someone closely involved with the administrative apparatus.

Why?

For the simple reason that many of the government officials who are proverbially pounding their chests, explaining how China deserves a morally clean future, have been guilty of blatant nepotism and favoritism themselves. To put it differently, a practice as ubiquitous as nepotism can simply not be eradicated in one fell swoop, especially by officials who have been guilty of just that and have just recently embraced the moral high ground… not exactly realistic and, again, closer to hypocrisy than a sustainable battle plan.

What are the implications for Western investors who are interested in either conducting business in China directly or at least gaining exposure to Chinese assets?

It is ultimately all a matter of “knowing the turf” or, in other words, making informed decisions that are based on a meaningful understanding of “all things China” (whether we are referring to the economic dimension, the cultural dimension, the political dimension or any other facet) rather than embracing an unjustifiably optimistic perspective based on superficial data.

One of the main aspects we would like to clarify for potential clients is that the ChinaFund.com team is in no way here to “sell” China as the perfect jurisdiction, where guaranteed profits are just around the corner. There is a reason why we are publishing hundreds of well-researched articles rather than limiting ourselves to a few talking points. It is because we firmly believe in painting an ACCURATE picture of Chinese reality, with the good, bad and downright ugly it occasionally entails.

By being optimistic when being optimistic makes logical sense and criticizing when we have valid reasons to do so, we are embracing a reality-oriented approach that is ultimately in the best interest of ourselves as investors as well as our clients. Everyone has an agenda, including our team. Fortunately for clients, ours is crystal-clear: by being a fee rather than percentage/commission-oriented team of consultants, we have no vested interest whatsoever in what you choose to invest or in which direction you choose for your portfolio.

We are simply here to guide you throughout the process and put our expertise at your disposal as best we can, not because we are amazingly generous human beings but because this approach is conducive to return business in our fee-oriented line of work… win-win or no deal, in other words. For more information on what we can do for your or your organization, visit the Consulting section of ChinaFund.com. Alternatively, simply reach out and send us a message through our website’s Contact section and we will get back to you as soon as possible.