Jun

Macroeconomics is yet another instance where phrases which revolve around the fact that the only constant is change are relevant. Times change, variables change, people change and macroeconomic trends cannot help but keep up. As such, it makes sense to keep the most important macroeconomic realities of the present in mind and be on the lookout for the opportunities as well as challenges that are likely to lie ahead.

Let’s start with, well… the present, and acknowledge that:

- We’re not in Kansas anymore. With Kansas being the “10% yearly growth” paradigm that has been the status quo in China up until 2010. Today’s economic growth goals (in the 6% to 6.5% region) are by no means tame, but it is clear that today’s China cannot possibly keep up with the explosive pattern we have gotten accustomed to… which is not inherently bad, as a perpetual 10%+ yearly growth trajectory is not exactly in the realm of sustainability

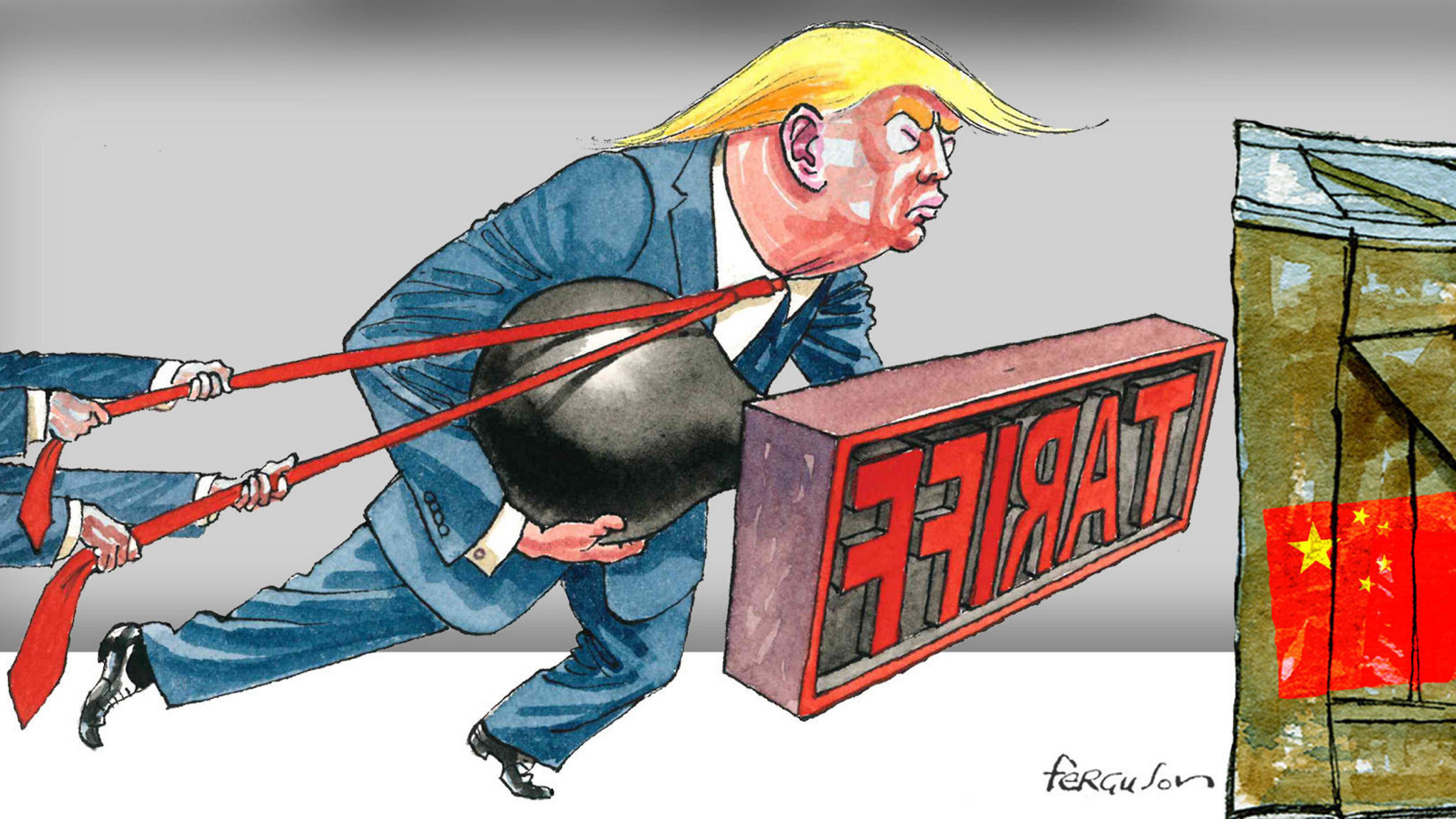

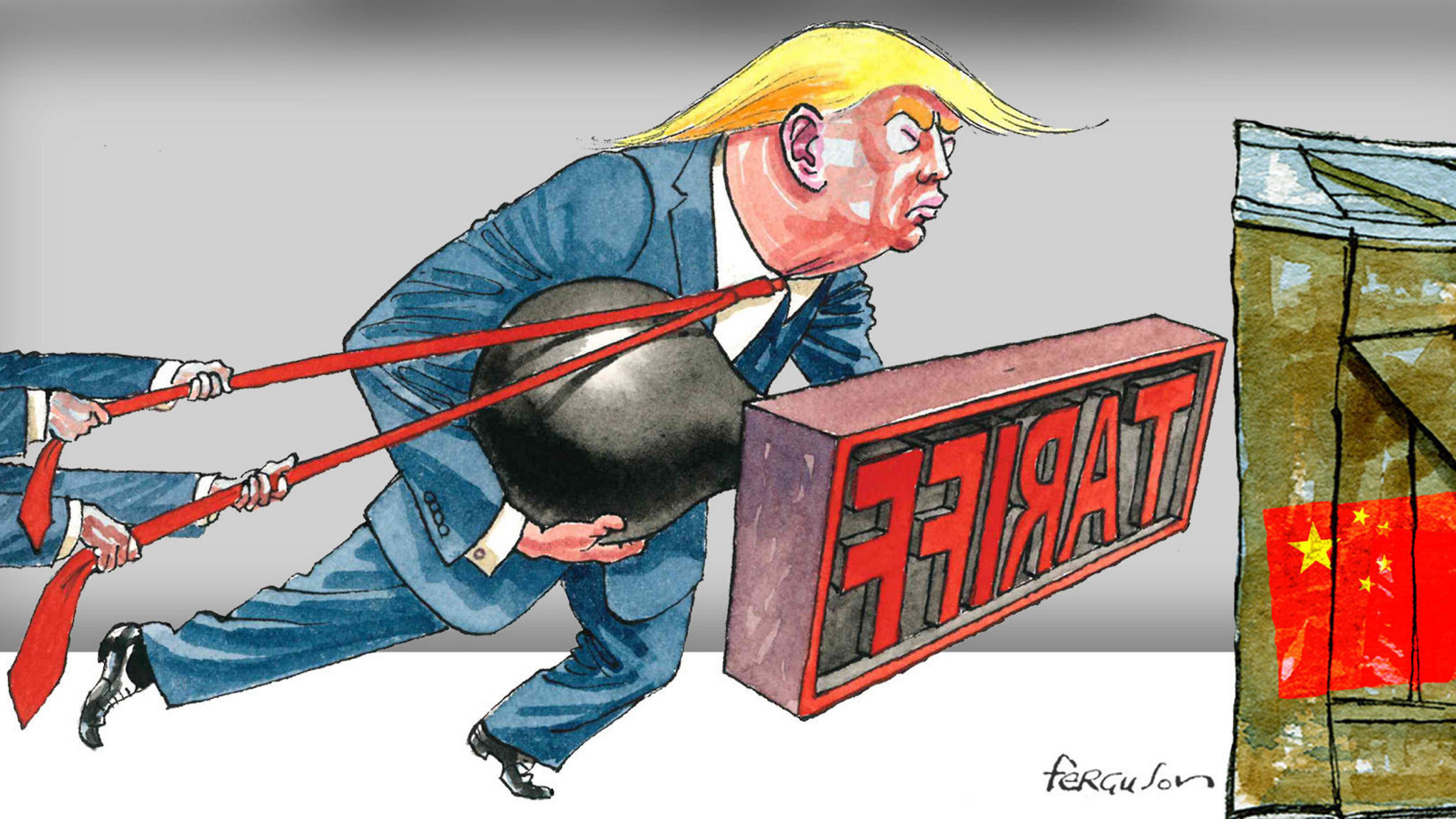

- China’s commercial surplus with a lot of economic superpowers is getting increasingly harder to swallow, with trading partners (with the most “vocal” example being that of the United States) being committed to doing something about the dramatic trade deficit they sometimes end up having with China

- China is no longer playing catch-up, it’s dominating or on the verge of dominating a wide range of industries, including cutting edge ones such as green energy (guess who the world’s number one producer of both solar and wind energy is?), robotics and artificial intelligence. While “oh, China just mass-produces cheap electronics” might be a common China-related discussion theme during family gatherings, it’s been many years since it is no longer anchored in reality

- Unfortunately, despite its huge GDP, China isn’t enjoying the benefits of having a “safe haven” status and as such, is more vulnerable to exogenous shocks such as financial crashes than let’s say the US. As frustrating and ironic as it may seem, China would most likely have more to suffer than the United States, even if the next financial crisis would (just like the 2007-2008 one) actually has its origins in the United States

- The US is taking steps back from its many roles of global leadership (with the Paris Agreement withdrawal being an example related to the environment, the Iran situation being an example related to defense/stability and the list could go on and on), with China displaying a clear willingness of stepping in

- Regionally speaking, China is strengthening its local influence and even blazing trails (Africa). Even when it comes to strategic defense partnerships such as that between the United States and South Korea, they don’t manage to overshadow the fact that China engages in quite a bit more trade with many of the most well-known allies of the US. In other words, despite the wide range of geo-strategic goals China’s neighbors and other nations have… the economic reality when it comes to their trade with China inevitably ends up putting a ceiling on their defense-related loyalty to the US

- Domestic consumption has become multiple orders of magnitude more important than people could have hoped a few decades ago. Once again, this is pretty much inevitable in light of the fact that growth sources need to be diversified. A nation cannot hope to continue on an exclusively export-driven growth trajectory indefinitely because, as today’s tense trade negotiations prove, your trading partners will eventually decide to be proactive and do something about the trade deficit situation

As far as the future is concerned:

- China is bound to ultimately display growth patterns in line with its maturing economy, something that risks generating structural imbalances if not enough measures are being taken for this landing to be soft. If you live by explosive growth, you die by explosive growth or to put it differently, you die once the explosive growth stops

- The world, over the next decades, will most likely move from being US-dominated to a multi-polar paradigm in which China will have a decisive role to play. It is highly unlikely that China itself will simply take over the role that the US has today… not impossible but definitely unlikely. What’s more likely is that a handful of super-economies will share global leadership roles and it is hard to imagine scenarios in which China is not one of them

- The average Chinese citizen needs to become more financially sophisticated because, quite frankly, he doesn’t have much choice. As more and more emphasis is placed on variables such as domestic consumption and as the population of China finds itself having more and more disposable income to work with, it becomes important to learn how to allocate such resources wisely and with long-term sustainability in mind

- More likely than not, China’s bets in Africa will end up generating impressive dividends down the road, as the African continent is eventually put in the position China was put in as of 1978: playing economic catch-up with the rest of the world. As that happens, the infrastructure and relationships China has put in place there will most likely result in quite a few benefits for the Chinese economy

- The world needs global goals to rally around, centered around species-definitely goals such as space exploration. Hopefully, these common goals will enable us to set our differences aside and lead to the replacement of trade-related bickering with pragmatic solutions that benefit the whole of humanity

- As time passes, China’s demographic issues can pose problems, as an aging population brings about unique challenges. We need not look all that far to see what can happen, with Japan’s present situation being more than relevant in that respect

- Finally, on the defense front, words cannot begin to describe how important it will be to find balance in a world where more and more players will have access to potentially humanity-destroying technology such as nuclear options

As can be seen, China tends to be quite well-positioned in this entire equation and while it is hard to envision a future where its role isn’t a leadership one (perhaps even the #1 leadership role), we need to understand that there will be bumps along the way, as has been the case with each and every economic superpower of the past.